Read & Written by John-Miguel Mitchell

Warren Buffett once said: “Only when the tide goes out do you discover who’s been swimming naked.”

In venture, the tide has gone out. And what we’re discovering isn’t a lack of capital or innovation — it’s a lack of cultural foundation.

Before we talk about systems, we need to talk about how culture is seen.

Most founders and investors still split into two camps:

| How Culture Is Commonly Viewed | How Culture Should Be Viewed |

|---|---|

| Buzzwords | Defined & designed |

| Not a priority | A strategic priority |

| Afterthought | At the forefront of decisions |

| Excuse to hide behind | Taken seriously — both qualitatively and quantitatively |

| Ambiguous | Measurable |

| Invisible | Visible |

Culture isn’t a vibe; it’s infrastructure.

And the gap between these two columns is what quietly breaks most startups when the market turns.

And the gap between these two columns is what quietly breaks most startups when the tide turns.

The next decade of venture and startup success won’t be determined by who raises the most capital or adopts the newest technology. It will be defined by who builds the cultural infrastructure to endure — systems that make conviction measurable, trust repeatable, and leadership scalable across cycles.

Startups don’t fail from lack of funding; they fail from lack of alignment.

Funds don’t lose from poor timing; they lose from poor integrity.

And the solution to both begins with treating culture as seriously as capital.

The Market Has Spoken: Endurance Beats Hype

When Sequoia Capital’s COO resigned after her colleague’s Islamophobic remarks — and the firm stayed silent — it wasn’t just a PR misstep. It was a structural failure. A firm built on conviction had none when it mattered.

That silence is the cost of inaction — the moment when reputation outpaces integrity. And it mirrors what’s happening across the venture ecosystem: the louder the market gets, the thinner conviction becomes.

This isn’t a new problem. It’s a forgotten truth.

Jeff Seibert put it plainly in The Infinite Game of Building Companies:

“Building a company isn’t a sprint to an exit; it’s an infinite game.”

Yet venture still behaves like it’s racing toward the next round — sprinting toward exits while the foundations crumble beneath them.

According to AngelList’s State of Venture H1 2025:

- The typical VC fund has delivered flat returns for 3½ years.

- Portfolios now average only 1.8 more good than bad updates, down from 6 before the pandemic.

- Startups founded during 2018–2022 — the “COVID-era cohort” — are underperforming as valuations outpaced fundamentals.

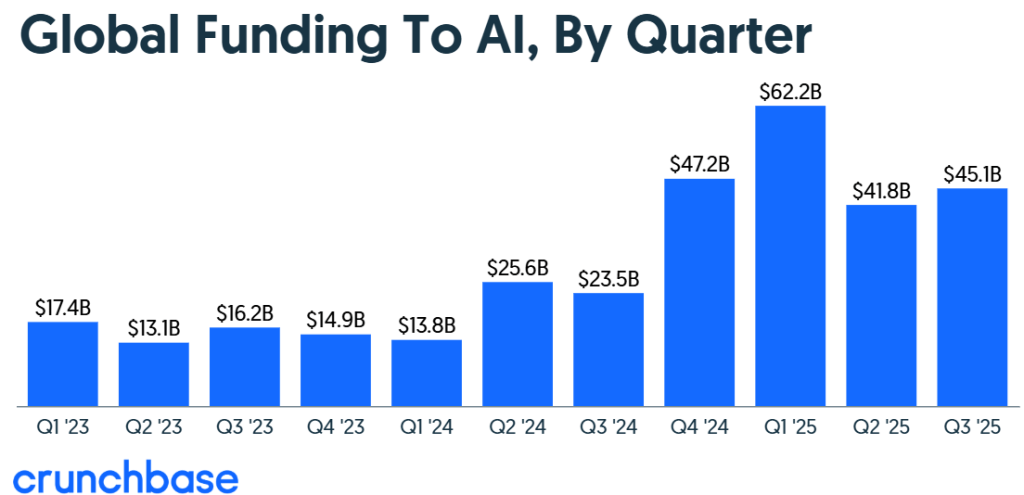

Meanwhile, Crunchbase’s State of Startups Q3 2025 reports that AI startups captured roughly 46 percent of all global venture funding in the last quarter — the highest share ever recorded.

Every other sector shrank.

In other words: capital has found a new obsession, but conviction hasn’t found its footing. Money keeps moving faster than discipline. The rising tide of AI capital is lifting some boats — but it’s exposing which ones were never seaworthy to begin with.

That’s not diversification; it’s dependency. And it’s exactly why cultural infrastructure now matters more than financial engineering.

Discipline isn’t financial — it’s cultural. The firms that endure won’t be the most funded; they’ll be the ones that built boats strong enough to weather any tide.

The Culture Infrastructure Model

If culture is the operating system, infrastructure is the code.

At Ekipo, we define Cultural Infrastructure as the architecture that turns values → behavior → systems → endurance.

| Dimension | Guiding Questions | Why It Matters |

|---|---|---|

| 🧭 Purpose | Why do we exist beyond revenue? What story anchors us when it’s hard? | Purpose is alignment. Without it, execution splinters. |

| 🏗 Management Structure | Who truly makes decisions here — and is that clear? | Clarity prevents politics and rumor economies. |

| 👤 Leadership Style | How do we handle feedback and conflict? | Leadership drift is the earliest sign of culture drift. |

| ⚙️ Workplace Practices | What behaviors do we reward — and which do we tolerate? | Rituals reveal what you actually value. |

| 🎨 Visual & Symbolic Artifacts | What does our environment say about our priorities? | Every wall, slide, and Slack thread sends a signal. |

From Insight to Infrastructure: Solutions for Founders

If Part 1 diagnosed founder-side risks — burnout, misalignment, drift — then Part 3 shows how to build the systems that prevent them.

These are not “feel-good” workshops. They are operating plans for conviction — measurable tools that help founders lead through uncertainty and scale without culture debt.

| Service | What It Is | Best For / Resonates With |

|---|---|---|

| 🟢 Clarity — Quick Wins / Talks / Pulse | 1-week Culture Snapshot or Founder Talks to spot trust gaps, burnout, or misalignment. | Pre-seed → Series A founders needing clearer communication and early signal on burnout. |

| 🟡 Alignment — Leadership Advisory / Decision Partnering | Culture X-Ray + Execution Sprint to reset leadership flow and clarity. | Seed → Series B founders with rapid growth or cofounder tension. |

| 🔴 Stability — Embedded Advisory / Crisis Readiness | Full-Stack Founder Coaching, Team Reset Workshops, and Crisis Support. | Series B+ / Growth stage companies managing reorgs or investor strain. |

These tiers form a founder’s culture operating plan — lean, measurable, and built for scale. But what does that actually mean for your bottom line?

💰 ROI Snapshots

⚡ Retaining five key hires saves ~$1M in replacement costs—research shows replacing an employee costs 50% to 200% of their annual salary.

⚡ Leadership clarity and structured reflection can improve productivity by up to 23%, accelerating delivery and investor confidence.

💣 Cost of Inaction (COI)

💥 Fundraising timelines have stretched from 3 months to 6-9 months—burnout-driven turnover compounds these delays as teams lose momentum.

💥 48% of entrepreneurs experience burnout, with 32% experiencing depression and 56% facing decision fatigue—founder mental health directly impacts execution speed and investor confidence.

💥 Unaddressed culture drift compounds as headcount scales—what takes weeks to fix at 10 people takes months at 100.

These tiers form a founder’s culture operating plan — lean, measurable, and built for scale.

Culture Infrastructure for VCs: Protecting the Capital Stack

If Part 2 exposed VC-side blind spots — drift, governance apathy, portfolio fragility — this is the cure: systems that protect valuation by protecting conviction.

Culture doesn’t just affect individual companies. It moves through portfolios like a tide — lifting the healthy and drowning the fragile. The question isn’t whether you’ll be affected. It’s whether you’ll see it coming.

| Service | What It Is | Best For / Resonates With |

|---|---|---|

| 🟢 Diagnose — Portfolio Quick Wins / Risk Radar | Culture Quick-Scan and VC Briefings that surface founder alignment and team trust risk. | Emerging managers, family offices, Series A–B funds wanting pattern recognition on founder stress. |

| 🟡 Advise — Core Advisory / Portfolio Diagnostics | Culture Diagnostic Audits across 5–10 startups, 1:1 Founder Advisory, and Post-Term Alignment. | Funds with 10–50 companies focused on retention and trust. |

| 🔴 Stabilize — Embedded Portfolio Partnership | Culture-as-a-Service Retainer + Crisis Triage Support for cofounder splits or PR crises. | Established funds, accelerators, multi-fund managers with reputation exposure. |

💰 ROI Snapshots

⚡ Early-stage VC funds typically see 40% of investments by name result in total or near-total losses—culture infrastructure helps identify which companies are at risk before they become write-offs.

⚡ Losing an employee costs organizations 1.5-2x the employee’s salary in replacement, onboarding, and training costs—reducing portfolio-wide attrition by just 10% across 10 companies can save millions annually.

💣 Cost of Inaction (COI)

💥 Unchecked founder drift creates silent portfolio attrition.

💥 Governance apathy delays intervention, compounding reputation damage.

💥 Cofounder disputes can cut portfolio IRR by 10–20%.

💥 Weak LP transparency erodes fundraising leverage.

These three tiers form the VC’s cultural infrastructure — a system for identifying risk early, preserving trust velocity, and converting leadership stability into valuation strength.

The Paradox of Venture: Speed vs Endurance

Venture capital was built on a paradox: move fast enough to catch lightning, but slow down enough to hold it.

For too long, the industry optimized for the first half — deploy faster, scale harder, exit quicker. But the market has changed the rules. The firms and founders still winning aren’t the ones moving fastest. They’re the ones built to last.

Culture isn’t the soft stuff. It’s the hull.

When conviction becomes infrastructure — when values aren’t posters but protocols, when alignment isn’t assumed but architected — startups stop sinking under pressure. And funds stop bleeding returns in silence.

The next wave of venture winners won’t be decided by who raised the biggest round or deployed the fastest capital. It will be won by those who treated culture like code: designed, debugged, and deployed with precision.

Because in an infinite game, the only competitive advantage left is the one that doesn’t erode when the tide turns.

Endurance isn’t luck. It’s architecture.

And it starts now.

Questions for Founders & VCs

1. If your culture were code, would it pass a code review — or get flagged as debt about to break production?

2. If your top performer quit tomorrow and wrote their exit story, would it confirm what you say you’ve built — or expose what you’ve actually tolerated?

3. Are you scaling infrastructure or just automating chaos?

4. For VCs, you track ARR and burn religiously — but can you name which three companies in your portfolio are one founder fight away from collapse?

5. If preventing one $10M write-down pays for culture infrastructure across your entire fund, why are you still calling it optional?

Article was read & written by John-Miguel Mitchell who is the Founder and Lead Consultant at Ekipo LLC. If you’d like to learn more about how to design and build out the ideal workplace culture for your business, email him at jmitchell@joinekipo.com.

Liked the blog? Click on the subscribe button below to get new content delivered directly to your inbox every Friday.