Written by John-Miguel Mitchell

Why this move protects incumbents and sabotages innovation.

Silicon Valley wouldn’t look the same without H-1B visas.

Satya Nadella (Microsoft), Sundar Pichai (Alphabet), and Elon Musk (Tesla) all built empires off the back of skilled immigration. Now imagine if each of their first visa applications had come with a $100,000 fee.

That’s not immigration reform. That’s startup suffocation.

Workplace culture isn’t about perks or posters on the wall. It’s the daily system that governs who you hire, how you build trust, and how you compete. By imposing a $100K “founder tax” on immigrant hires, the U.S. government is closing off the oxygen supply to early-stage companies.

The direct result is culture collapse:

- Hiring funnels shrink into clone factories, where everyone looks and thinks the same.

- Compensation spirals trigger morale gaps that fracture teams.

- Weak benches create execution drag that investors eventually punish.

As Sophie Alcorn, a Silicon Valley immigration attorney, put it bluntly:

“This policy is suffocating our most promising ventures in the cradle.”

The proposed $100K H-1B fee isn’t just a tax on immigration — it’s a tax on innovation. By choking off access to global talent, the policy forces startups into clone factories, distorted compensation models, and brittle teams. That’s not a “future of work” problem, it’s a workplace culture crisis: the very oxygen of trust, creativity, and execution is cut off before companies can scale.

When culture collapses at the hiring stage, innovation dies before it ever hits the market.

VCs: This Becomes Portfolio Drag

This isn’t just a hiring headache—it’s a valuation drag you’ll feel in every diligence cycle:

- Exec churn = credibility hit. Acquirers and analysts probe weak benches. Raises stall. IPO paths get delayed.

- Economic diversity gaps flagged. Investors know that homogenous teams over-index on blind spots. When your talent pool narrows, your execution risk widens — and multiples compress.

- Overpay = desperation signal. Comp ratios get flagged. Term sheets tighten. Markets misread the company as unstable.

Eugene Malobrodsky of One Way Ventures framed it perfectly:

“For somebody like OpenAI, Anthropic, Google or Microsoft – $100,000 is what they might spend on soap in their office. For startups, it’s impossible.”

Pushback & Rebuttals

Some will say this is alarmist. ‘Hire Americans. Compete harder. Go remote.’ But the data and reality don’t back that up.

Pushback #1: “Startups should just hire American workers.”

Rebuttal: The U.S. doesn’t graduate enough engineers to meet demand.

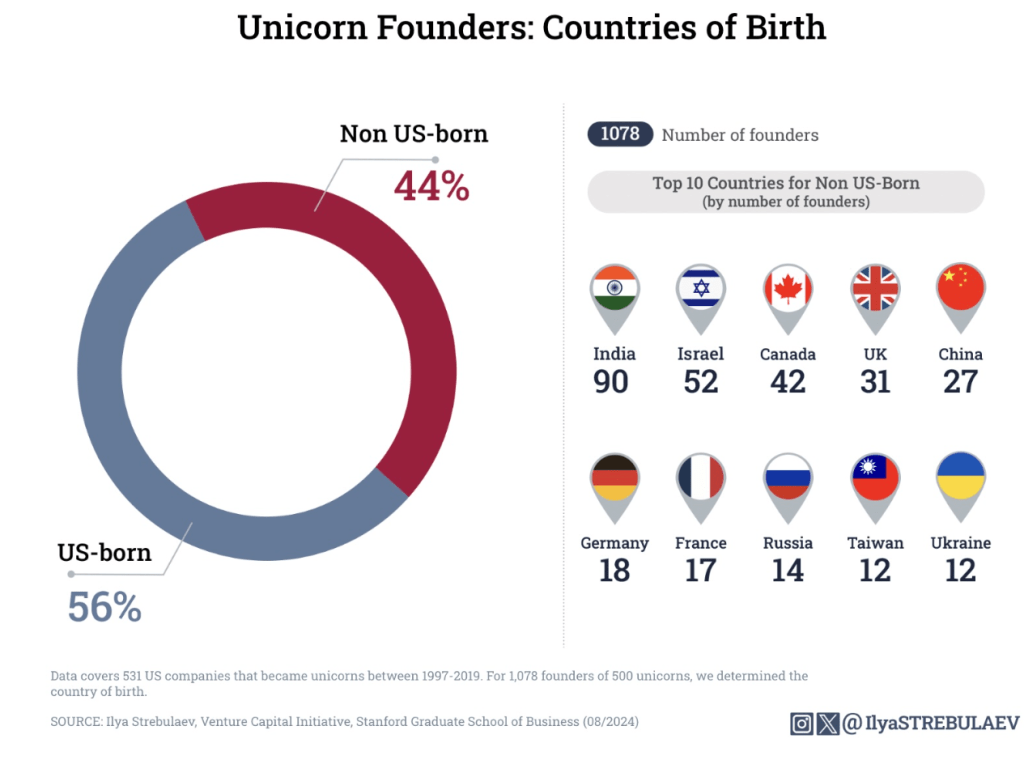

44% of America’s unicorn founders were born outside the country. Without global input, the pipeline collapses.

Pushback #2: “$100K ensures only the ‘best’ immigrants get through.”

Rebuttal: Wrong. It doesn’t screen for quality—it screens for capital. Big Tech can pay; scrappy startups can’t.

Pushback #3: “Most startups don’t use H-1Bs anyway.”

Rebuttal: That’s like saying “startups don’t need venture capital.” The ones that scale fastest do depend on it.

Pushback #4: “Just go remote/global.”

Rebuttal: Immigration rules still matter for leadership optics, investor confidence, and scaling in U.S. markets. Slack channels don’t replace in-country presence.

Alcorn again:

“The result is a simple, brutal equation: without access to this talent, startups will die, move abroad, or never be founded in the first place.”

Which means the cost of inaction isn’t abstract — it’s startups that never get built.

This Isn’t Clumsy, It’s Calculated

If you’re a founder, that’s not just policy risk — that’s existential risk.

Let’s be real: this isn’t about protecting American workers. It’s about protecting Big Tech.

- Amazon, Apple, Google can swallow $100K per visa.

- A seed-stage company in a garage can’t.

- The result? Less competition, more consolidation, fewer challengers to incumbents.

As Alcorn warns:

“This is not just a brain drain; it’s a ‘brain push.’ We are actively sending brilliant minds already in our country into the open arms of competitors in China and the Middle East, who are rolling out the red carpet.”

Because at the end of the day, you can’t outsource culture — and culture dies first when talent funnels close.

What Founders Can Still Do

You may not control Washington. But you control your hiring strategy and investor narrative. Break it down this way:

Things You Can Control

- Run the numbers. Show your board what $100K per visa does to burn and runway. Control the narrative before they assume.

- Protect your comp philosophy. Audit pay compression now, before morale erodes under overpay spirals.

- Design for economic diversity. Codify hiring principles to avoid clone factories. You’re not just hiring “different faces” — you’re hedging risk and expanding market reach.

Things You Can Directly Influence

- Talent pipelines. Build relationships with universities, accelerators, and diaspora groups before you’re desperate.

- Investor expectations. Brief VCs early on how you’re mitigating talent risk. Don’t wait for diligence to flag it.

- Distributed ops. Get remote-ready now. Make “global-first” a core capability, not a crisis patch.

Things You Can Indirectly Influence

- Policy advocacy. Join coalitions of founders, VCs, and immigrant leaders who push back collectively. One startup gets ignored; a bloc gets heard.

- Ecosystem pressure. Align with portfolio peers—LPs and GPs are already nervous about valuation drag. Use that leverage.

- Public narrative. Point out the hypocrisy: “We’re talking about stopping the next Eric Yuan of Zoom or Jensen Huang of Nvidia before they can even start.”

Final Word

Alcorn captured it best:

“The result is simple, brutal: without access to this talent, startups will die, move abroad, or never be founded.”

Founders: this isn’t a policy side note. It’s your runway, your talent pool, your execution risk.

VCs: this isn’t immigration. It’s portfolio health.

The question isn’t whether this policy is bad. The question is: how many unicorns will be strangled in the crib before the startup ecosystem fights back?

Questions for Founders & VCs

- If you’re forced into a clone factory of hires, what blind spots are you building into your culture from day one?

- Is your burn rate higher because of growth — or because you’re paying a hidden “founder tax” to access talent?

- What’s more dangerous to your startup: a bad market, or a brittle team built under comp distortion and talent scarcity?

- For VCs, if 44% of unicorn founders are non–US-born, how do you plan to defend portfolio returns when Washington taxes almost half your potential pipeline?

Article was read & written by John-Miguel Mitchell who is the Founder and Lead Consultant at Ekipo LLC. If you’d like to learn more about how to design and build out the ideal workplace culture for your business, email him at jmitchell@joinekipo.com.

Liked the blog? Click on the subscribe button below to get new content delivered directly to your inbox every Thursday.