Read and Written By John-Miguel Mitchell

Quick Plug-In: If you’d like to learn more about Pepperdine University’s Most Fundable Companies event, check out the link here. I highly recommend it for startup founders & investors.

In 1877, Thomas Edison gave us the phonograph at Menlo Park — a breakthrough so practical it made him “The Wizard of Menlo Park” almost overnight. His lab became an “Invention Factory,” where ideas turned into adoption.

Fast forward to Meta Connect 2025 (held in Menlo Park), and Mark Zuckerberg pitched Ray-Ban Display smart glasses as the next leap — but unlike Edison, his vision was all spectacle, no substance.

Another shiny product launch, another bold promise of “superintelligence.”

Sound familiar? It should. We’ve seen this movie before — with Oculus.

Context: Oculus was Meta’s (then Facebook’s) $2 billion bet on virtual reality, pitched as the future of work and human connection. Instead, it delivered clunky headsets, motion sickness, and empty VR chatrooms — a costly distraction that burned billions without mainstream adoption.

Meta’s smart glasses aren’t just a product gamble—they’re a cultural mirror. They reveal what happens when founders prioritize spectacle over substance, investors chase hype instead of discipline, and boards ignore how fragile culture becomes when tethered to a single “game-changing” bet.

The Illusion of “Superintelligence”

Mark Zuckerberg is selling these glasses as the gateway to a new era of human–machine interaction. Gosh, that sounds so cheesy. If a little bit of throw up just came out of your mouth, I’m sorry.

VCs should recognize the pattern here:

- 🚀 Hype Cycle Trap: Overpromise, underdeliver.

- 💸 Cash Burn: Pouring billions into tech no one actually adopts.

- 🙈 Culture Blindness: Mistaking technological possibility for cultural readiness.

This isn’t vision. It’s drift.

And consumers aren’t buying the latest version of the pitch either.

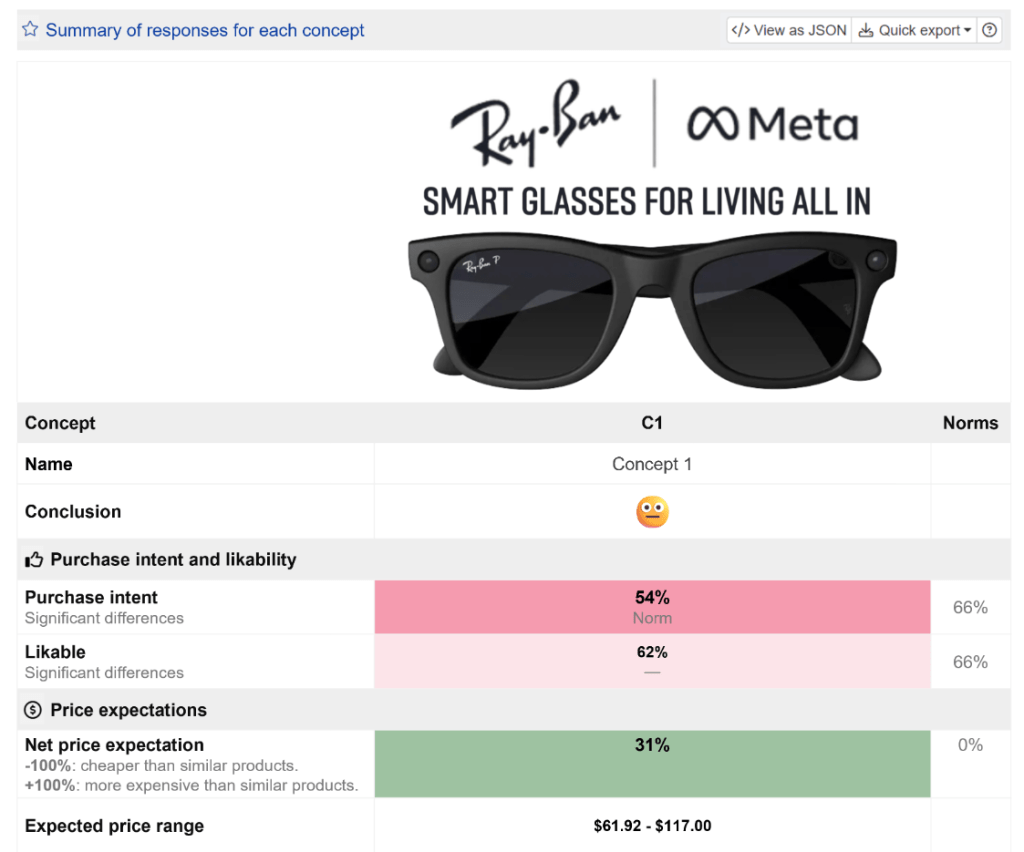

According to conjointly, intent to purchase Meta’s Ray-Ban smart glasses sits well below category norms — likability and willingness to pay trail expectations too. This isn’t just a technology gap; it’s a cultural rejection.

And if you’ve seen the 30-second ad Meta is running for these glasses, the pitch is pure lifestyle hype: ‘Live all in.’ It’s sleek, emotional, and aspirational — but notice what’s missing: any evidence of real adoption or workplace utility. Here’s the spot:

This is exactly how drift starts. Founders over-index on branding and vision, while investors mistake polished ads for proof of cultural readiness. The gap between commercial hype and consumer adoption isn’t just marketing fluff — it’s execution risk in disguise.

Culture Drift in 3 Costly Flavors

And Meta isn’t alone. From ice cream to satellites, culture drift follows the same pattern: identity gets bent to fit markets, contracts, or trends, and execution risk explodes. Here are three flavors of drift every investor should recognize.

1. Tech Hype (Meta/Oculus/Smart Glasses)

The workplace didn’t want VR meetings, and it won’t want surveillance glasses. The failure wasn’t hardware — it was ignoring how humans actually build trust and communicate. That cultural blind spot turned into billions of wasted dollars and years of stalled execution.

2. Mission Silenced (Ben & Jerry’s/Unilever)

Jerry Greenfield’s exit this month is another form of drift. After nearly 50 years, he quit saying Unilever had “silenced” Ben & Jerry’s social mission — the very DNA that made the brand valuable. When purpose is stripped out, execution risk skyrockets: disengaged employees, alienated customers, and brand erosion investors can’t ignore.

3. Geopolitical Gold Rush (Space Tech Startups)

Meanwhile, space startups are chasing defense contracts in a global rearmament boom. The FT reports a feeding frenzy as founders pivot from commercial markets to defense funding. But this drift comes at a cost: execution becomes hostage to procurement cycles, geopolitics, and incumbents — not the company’s original mission. When your culture bends to outside forces, you may win contracts but lose control of your identity.

Why VCs Should Care

Across all three, the same issue emerges: when culture drifts, execution risk explodes.

- Priorities blur.

- Milestones slip.

- Morale erodes.

- Valuation drags.

And here’s the kicker: Culture drift is silent but costly. You don’t always see it in the deck — but you always pay for it in performance.

Countering Drift: Practical Steps for Investors

If drift eats execution, then execution eats valuation. The question for VCs isn’t whether culture drift exists in your portfolio — it’s where it’s hiding. The good news: there’s a playbook to counter it.

| Quick Win | What It Means |

|---|---|

| Request 1-page “failure audits” from CEOs | Ask portfolio founders to document, in one page, what they learned from a failed bet, pivot, or product that didn’t land. |

| Add culture health signals to board reviews | Add a slide to board decks tracking turnover, trust, and leadership stability alongside financials. |

| Share contrarian case studies of disciplined growth | Highlight companies (portfolio or external) that resisted hype cycles and thrived. |

| Short-Term Solution | What It Means |

|---|---|

| Create a “hype-to-execution ratio” in pitch reviews | Score how much of a founder’s deck is hype vs. realistic delivery. |

| Quarterly board-level culture reviews | Add structured time to discuss team health, turnover, and leadership alignment. |

| Require culture resilience indicators in updates | Founders must report on trust scores, retention, or leadership depth. |

| Long-Term Solution | What It Means |

|---|---|

| Fund culture-first accelerators | Back programs that train founders to resist hype traps early. |

| Reward disciplined execution in LP updates | Showcase boring-but-effective portfolio wins, not just flashy raises. |

| Pressure-test portfolio companies against “Oculus moments” | Ask: what happens if the flagship bet fails? Can culture still execute? |

What Meta Defenders Will Say (and the Reality)

Of course, some will argue Meta is just “playing the long game” or that disruption always looks messy. You’ll hear these defenses. Here’s why they don’t hold up.

| Pushback from Meta/Facebook Apologists | Rebuttal for VCs |

|---|---|

| “You’re underestimating the long game—Oculus laid AR/VR foundations.” | Long game ≠ infinite patience. Oculus distracted Meta’s culture and weakened execution. For VCs, portfolio companies don’t have the balance sheet to absorb cultural drift while “waiting it out.” |

| “Disruption always looks messy. The iPhone was dismissed too.” | The iPhone solved immediate consumer needs. Meta’s glasses still lack a market-ready problem to solve. For VCs, funding “solutions in search of problems” accelerates culture debt. |

| “Meta can afford billion-dollar bets. This is diversification, not recklessness.” | Resources ≠ resilience. A trillion-dollar balance sheet can mask fragility, but it can’t buy back trust or culture once cracks appear. Your portfolio companies don’t have that luxury—discipline is their only hedge. |

Once you strip away the excuses, the lesson is clear. The real superintelligence isn’t in hardware, defense contracts, or corporate spin. It’s in protecting culture as infrastructure — the only hedge against drift.

Culture Is the Real Superintelligence

Zuckerberg thinks the future of work is hardware. Unilever thought purpose could be muted without consequence. Space founders think defense dollars equal sustainability. They’re all wrong.

The real superintelligence is executional discipline rooted in culture. Funds that safeguard this outperform those chasing hype.

So when you hear promises of “superintelligence” from a pair of glasses, remember: Oculus made the same promises. Billions later, Meta is still searching for adoption.

For VCs, the lesson is clear: don’t put your eggs in the shiny-object basket. Protect your portfolio from drift before execution risk destroys value.

Questions for VC Firms

- Are you measuring hype-to-execution drift in your portfolio, or just ARR?

- If your founders ran a “failure audit” tomorrow, would you like what you read?

- How many of your portfolio wins are discipline-driven, not just PR-driven?

- When culture drifts, execution risk multiplies — do you have a playbook for catching it before valuations collapse?

Article was read & written by John-Miguel Mitchell who is the Founder and Lead Consultant at Ekipo LLC. If you’d like to learn more about how to design and build out the ideal workplace culture for your business, email him at jmitchell@joinekipo.com.

Liked the blog? Click on the subscribe button below to get new content delivered directly to your inbox every Thursday.